This article may contain affiliate links. For details, visit our Affiliate Disclosure page.

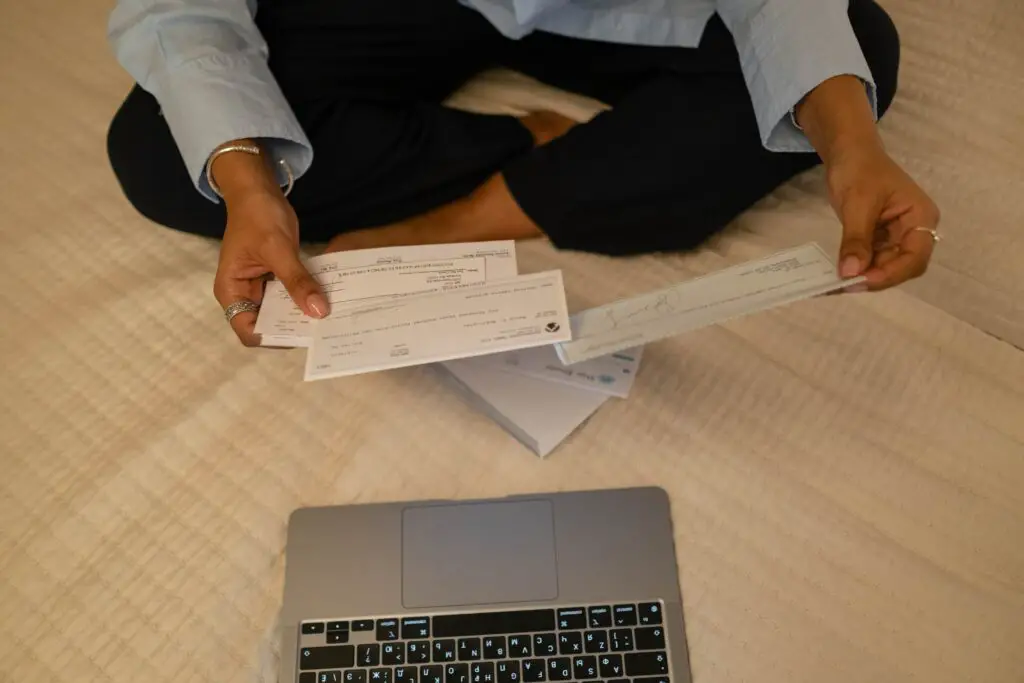

Writing a $10,000 check can be an intimidating task, especially if you’re not accustomed to dealing with large amounts of money. It’s natural to feel a bit apprehensive, wondering whether or not you have the funds to cover the check, or if it’s even legal to write a check for that amount. Fortunately, there are some key things to keep in mind when it comes to writing a $10,000 check that can help ease your concerns. In this blog post, we’ll explore the ins and outs of writing a $10,000 check, covering everything from legal considerations to practical tips for ensuring that your check is processed smoothly.

The Legal Considerations of Writing a $10,000 Check

Writing a $10,000 check is perfectly legal, but there are some important considerations to keep in mind before you do. First and foremost, it’s important to be aware of the Bank Secrecy Act (BSA), a federal law that requires financial institutions to report any transactions over $10,000 to the Internal Revenue Service (IRS). This means that if you write a check for $10,000 or more, your bank will be required to report the transaction to the IRS.

It’s also worth noting that if you’re writing a $10,000 check as part of a business transaction, you may be subject to additional reporting requirements. For example, if you’re paying a vendor for goods or services and the total amount paid to that vendor over the course of the year is $600 or more, you’ll need to file a Form 1099-MISC with the IRS. This form documents the payment you made to the vendor and is used by the IRS to ensure that the vendor reports the income on their tax return.

Tips for Writing a $10,000 Check

Now that you’re aware of the legal considerations, let’s dive into some practical tips for writing a $10,000 check. First and foremost, make sure that you have the funds available to cover the check. Writing a check that bounces can result in significant fees and damage to your credit score, so it’s essential to be certain that the money is there before you write the check.

Next, double-check that you’re writing the check to the correct person or entity. If you’re paying a bill or making a purchase, make sure that you have the correct name and address of the recipient. If you’re writing a check to an individual, ensure that you have their full legal name to avoid any confusion.

When filling out the check, be sure to write the amount in both words and numbers. This helps prevent any confusion or errors when the check is processed. It’s also a good idea to write a memo on the check, indicating what the payment is for. This can be helpful if there’s ever any question or dispute about the transaction.

Finally, it’s essential to sign the check. Without a signature, the check is not considered valid and will not be processed. Make sure that your signature matches the signature on file with your bank to avoid any delays or issues.

Alternatives to Writing a $10,000 Check

If you’re uncomfortable writing a $10,000 check, there are other options available. One alternative is to use a wire transfer. Wire transfers are electronic transactions that allow you to transfer money directly from your bank account to the recipient’s bank account. They’re fast and secure, and often have lower fees than writing a check.

Another option is to use a cashier’s check. A cashier’s check is a check that’s issued by your bank, rather than by you personally. This can provide an added layer of security and can be a good option if you’re concerned about the legitimacy of the recipient.

Conclusion

In conclusion, writing a $10,000 check is legal, but there are important legal and practical considerations to keep in mind. The Bank Secrecy Act requires financial institutions to report transactions over $10,000 to the IRS, and if you’re making a payment as part of a business transaction, you may be subject to additional reporting requirements. When writing the check, be sure to have the funds available and double-check the recipient’s name and address. Write the amount in both words and numbers, include a memo, and sign the check.

If you’re uncomfortable with writing a $10,000 check, consider alternatives like wire transfers or cashier’s checks. Whatever method you choose, always ensure that you have the necessary funds available and that you’re following any legal reporting requirements.

Writing a $10,000 check may seem like a daunting task, but with the right preparation and attention to detail, it can be a straightforward and simple process. Just remember to keep these tips in mind, and you’ll be well on your way to writing your $10,000 check with confidence.