This article may contain affiliate links. For details, visit our Affiliate Disclosure page.

Introduction:

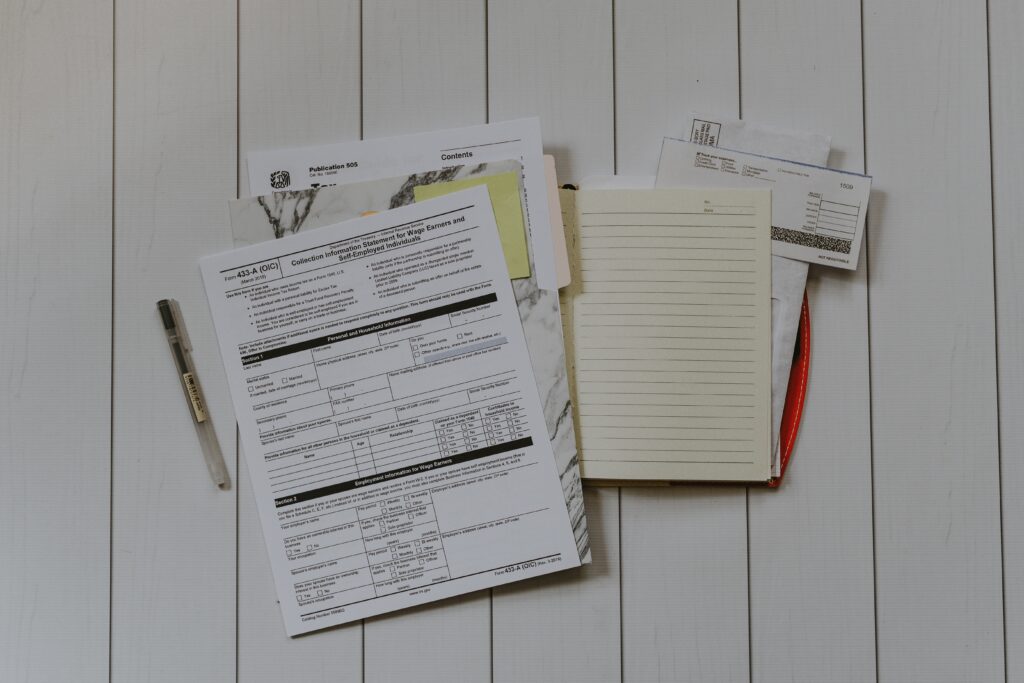

Are you eagerly waiting for your refund to arrive? Are you wondering if weekends should be included in the waiting period? This is a common question that often comes up when waiting for refunds, especially during the tax season. In this blog post, we will explore whether weekends should be counted when waiting for refunds in 2023. We will examine the rules and regulations surrounding the refund process and provide you with all the information you need to know.

The Refund Process:

The refund process can be a confusing and frustrating experience for many individuals. To understand whether weekends should be counted when waiting for refunds in 2023, it is essential to first understand how the refund process works. When you file your tax return, the Internal Revenue Service (IRS) begins to process your return and checks it for errors and discrepancies. Once your return is processed and accepted, the IRS will begin to issue your refund.

The Waiting Period

The waiting period for your refund can vary depending on several factors, such as the method of filing your return, the accuracy of your return, and the time of the year. Generally, the waiting period for a refund is around three weeks if you file your return electronically and around six weeks if you file a paper return. However, during the peak tax season, the waiting period may be longer. It is important to note that the waiting period does not include weekends and holidays. The IRS only processes and issues refunds during regular business days, which are Monday through Friday.

It is also important to note that the waiting period for refunds may be extended if there are errors or discrepancies in your return. For example, if you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), your refund may be delayed. The Protecting Americans from Tax Hikes (PATH) Act requires the IRS to hold refunds for taxpayers who claim these credits until mid-February to verify the accuracy of their returns. In this case, weekends and holidays will not be counted in the waiting period.

Direct Deposit vs. Mailed Check

When you file your return, you have the option to choose how you would like to receive your refund – either through direct deposit or a mailed check. The method you choose can also affect the waiting period for your refund.

If you choose to receive your refund through direct deposit, you can typically expect to receive your refund within one to two business days after the IRS issues it. Direct deposit is the fastest and most secure way to receive your refund. However, if there are errors or discrepancies in your return, the waiting period for your refund may be longer.

On the other hand, if you choose to receive your refund through a mailed check, you can expect to receive your refund within two to four weeks after the IRS issues it. This is because the check has to be printed, processed, and mailed to your address. If there are errors or discrepancies in your return, the waiting period for your refund may be longer.

Conclusion:

In conclusion, the waiting period for your refund does not include weekends and holidays. The IRS only processes and issues refunds during regular business days, which are Monday through Friday. However, it is important to note that the waiting period may be extended if there are errors or discrepancies in your return or if you claim certain credits. Choosing direct deposit is the fastest and most secure way to receive your refund, but the waiting period may still be longer if there are errors or discrepancies in your return. Regardless of how you choose to receive your refund, it is important to be patient and allow the IRS the necessary time to process your return and issue your refund.