This article may contain affiliate links. For details, visit our Affiliate Disclosure page.

Introduction

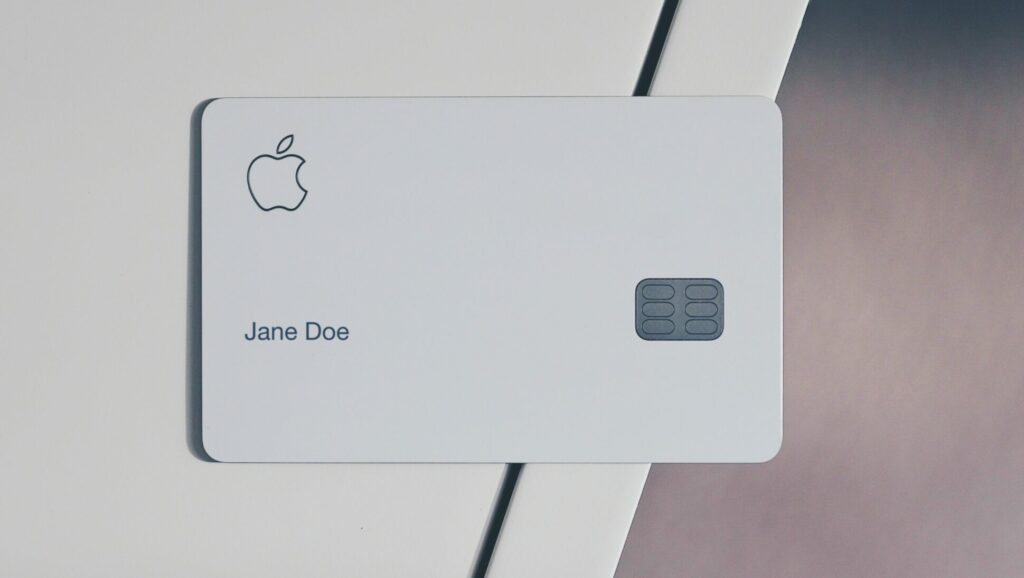

In the vast universe of credit cards, Apple Card has emerged as a distinct player, enthralling tech enthusiasts and finance aficionados alike. The sleek titanium card with its digital integration offers a seamless and innovative user experience. As potential applicants delve into the nuances of this financial tool, a pertinent question arises: What is the lowest credit limit for the Apple Card? In this comprehensive exploration, we will dive deep into the realm of credit limits, unraveling the factors that influence them, and shedding light on the specific thresholds that define the Apple Card’s minimum credit limit.

Understanding Credit Limits: The Foundation of Financial Freedom

- The Significance of Credit Limits in Credit Cards

Credit limits form the bedrock upon which credit card transactions are built. They represent the maximum amount of credit extended to a cardholder by the issuing financial institution. These limits play a vital role in defining the scope of financial freedom and responsibilities for credit card users. The credit limit affects not only the purchasing power but also the overall creditworthiness and financial profile of an individual.

- Factors Influencing Credit Limits

Various factors influence the determination of credit limits, including an individual’s credit history, income, debt-to-income ratio, credit utilization ratio, and overall financial stability. Financial institutions meticulously evaluate these factors to assess an applicant’s creditworthiness and calculate an appropriate credit limit. By analyzing an individual’s past behavior, income level, and financial commitments, credit card issuers aim to strike a balance between risk and reward.

Unveiling the Apple Card Credit Limit: The Search for the Bottom Threshold

- Introduction to Apple Card: A Fusion of Innovation and Simplicity

Before diving into the specifics of the Apple Card’s credit limit, it’s essential to grasp the essence of this distinctive credit card. Created in partnership with Goldman Sachs and powered by Mastercard, the Apple Card combines a physical card and a digital wallet seamlessly integrated into the Apple ecosystem. With its emphasis on privacy, security, and user-friendly features, the Apple Card has garnered attention and attracted a diverse range of potential users.

- The Apple Card’s Credit Limit Philosophy: Unique Perspectives

In its pursuit of offering an exceptional customer experience, Apple has crafted a credit limit philosophy that sets it apart from traditional credit card issuers. While exact details of this philosophy are not publicly disclosed, it is evident that the Apple Card aims to democratize access to credit, focusing on inclusivity and ease of use. By leveraging its vast ecosystem, Apple seeks to simplify the credit application process and provide transparent financial management tools to its users.

Delving into the Apple Card’s Minimum Credit Limit: Decoding the Threshold

- Minimum Credit Limits and Individual Factors

The determination of the Apple Card’s minimum credit limit involves a complex interplay of factors unique to each applicant. While the precise numerical value of this limit remains undisclosed, it is important to understand that Apple Card’s credit limits are dynamic and personalized. They are tailored to the financial circumstances, creditworthiness, and overall risk assessment of individual applicants. Thus, it is essential to approach the Apple Card application process with an open mind, recognizing that the credit limit offered will be reflective of one’s financial profile.

- Apple Card’s Gradual Credit Limit Increase

In line with its customer-centric approach, Apple Card offers potential for credit limit increases over time. As users establish a positive credit history and demonstrate responsible financial behavior, the Apple Card algorithm may evaluate and reward them with higher credit limits. This gradual credit limit increase is a testament to Apple’s commitment to empowering its customers and providing them with the tools to achieve financial growth.

The Apple Card Credit Limit: An Enigmatic Threshold Revealed

- Transparency: Apple’s Approach to Credit Limits

While the precise lowest credit limit for the Apple Card remains undisclosed, Apple strives to maintain a level of transparency in its communication with potential cardholders. Unlike some traditional credit card issuers, Apple aims to offer clarity and simplicity in its credit limit assessment process. By leveraging its intuitive interface and user-friendly design, Apple provides applicants with a transparent and streamlined experience, ensuring that they are well-informed about the credit limit they can expect.

- The Role of Financial History in Credit Limit Determination

When assessing an applicant’s creditworthiness, Apple Card takes into account their financial history. Factors such as past credit card usage, loan repayments, and responsible financial behavior are evaluated to ascertain the individual’s risk profile. By considering an applicant’s financial history, Apple can make informed decisions regarding credit limits, ensuring that they align with the applicant’s demonstrated financial responsibility.

Empowering Users: Maximizing the Apple Card Credit Limit

- Proactive Measures: Optimizing Your Credit Limit

While the lowest credit limit for the Apple Card may be subject to various factors, applicants can take proactive measures to potentially maximize their credit limit. Maintaining a healthy credit score, minimizing outstanding debts, and responsibly managing credit utilization can contribute to a favorable credit limit assessment. By showcasing financial responsibility and stability, applicants can enhance their chances of receiving a higher credit limit, allowing them to leverage the full potential of the Apple Card.

- Financial Management Tools: Navigating Credit Limits

As part of its commitment to empowering users, Apple Card offers robust financial management tools to help individuals navigate their credit limits effectively. Through the Apple Wallet app, users gain access to detailed spending insights, real-time transaction notifications, and personalized suggestions for managing their credit. These tools enable users to make informed decisions, monitor their credit utilization, and maintain a healthy financial profile, ultimately optimizing their credit limit and overall financial well-being.

Conclusion

In the realm of credit cards, the Apple Card stands as a testament to the power of innovation and simplicity. While the exact lowest credit limit for the Apple Card remains undisclosed, it is evident that Apple’s philosophy revolves around inclusivity, transparency, and empowering users to achieve their financial goals. By leveraging its vast ecosystem, intuitive interface, and personalized credit limit assessment, Apple aims to redefine the credit card experience.

As potential applicants embark on their journey with the Apple Card, understanding the intricacies of credit limits becomes paramount. By recognizing the influence of factors such as financial history, income, and responsible financial behavior, applicants can navigate the credit limit assessment process with confidence. Through proactive measures and effective utilization of the financial management tools provided, users can optimize their credit limit, unlocking the full potential of the Apple Card as a powerful financial tool.

In the ever-evolving landscape of credit cards, the Apple Card has emerged as an embodiment of technological prowess and financial convenience. While the lowest credit limit for the Apple Card remains shrouded in mystery, its commitment to transparency, customer-centricity, and gradual credit limit increases reflects Apple’s dedication to empowering its users. So, as you embark on your journey with the Apple Card, remember to embrace the possibilities, manage your finances wisely, and unlock the true potential of this modern marvel.