This article may contain affiliate links. For details, visit our Affiliate Disclosure page.

Introduction:

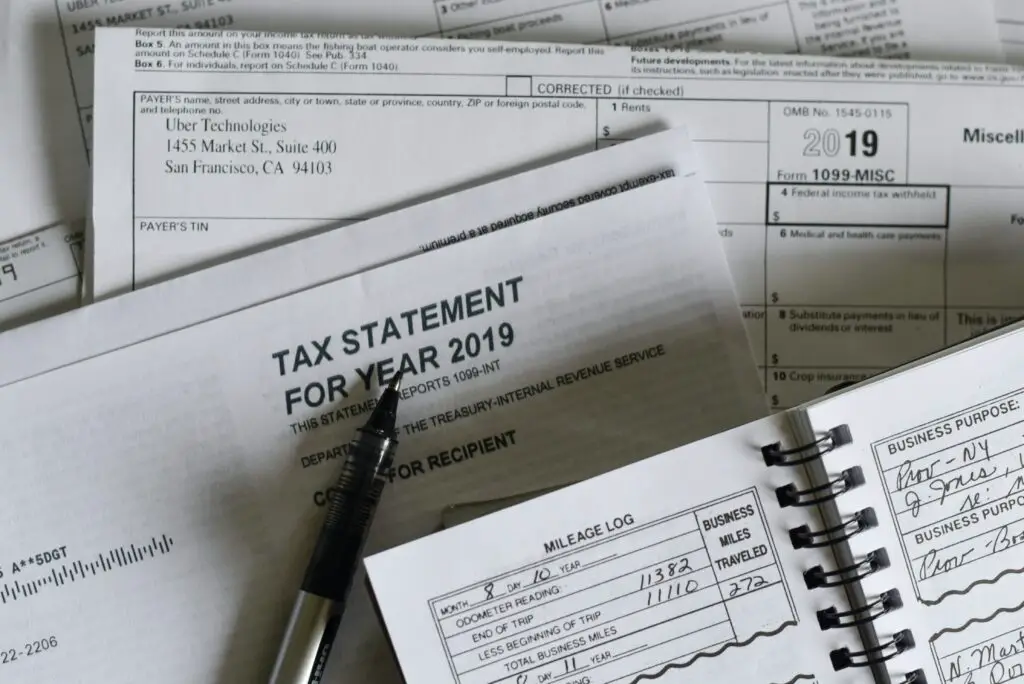

In the intricate realm of taxation, there comes a point when individuals may wonder, “When can I finally bid adieu to file taxes?” The answer to this query delves into a labyrinth of rules and regulations, interwoven with personal circumstances and legal thresholds. Join us on this enlightening journey as we explore the question of when one can escape the clutches of tax filings and embrace a life unburdened by annual returns. Brace yourself for a captivating exploration of tax freedom.

Childhood Years: The Prelude to Tax Responsibility

From the moment we arrive in this world, our lives are marked by milestones and responsibilities. However, when it comes to taxes, childhood grants us a temporary respite from the intricacies of financial filings. As a youngling, your main focus revolves around learning, growing, and building the foundation for a prosperous future. While children might engage in activities like babysitting or mowing lawns to earn pocket money, they typically don’t meet the income thresholds that trigger tax obligations.

During these formative years, it’s crucial to nurture a foundation of financial literacy. Although children may not have a tax burden to bear, they can still grasp fundamental concepts such as budgeting, saving, and making informed spending decisions. By instilling these skills early on, we equip the next generation with the tools needed to navigate the complex world of taxation in due time.

Adolescence: Part-Time Jobs and Tax Filing Considerations

As adolescence dawns and the journey into young adulthood unfolds, part-time jobs become a common rite of passage. Whether it’s flipping burgers, assisting with retail sales, or delivering newspapers, teenagers often seek employment to gain financial independence and cultivate a sense of responsibility. However, this newfound income raises questions about potential tax obligations.

While most teenagers earn modest amounts, it’s essential to recognize that the threshold for tax filing requirements varies from one year to another. In the United States, for instance, the Internal Revenue Service (IRS) adjusts the income threshold annually. As of the latest available information, for the tax year 2021, individuals under the age of 65 with earned income exceeding $12,550 must file a federal tax return. However, it’s worth noting that this threshold can fluctuate, and it is advisable to consult the current regulations and guidelines when determining tax obligations.

During this phase, it is vital to cultivate a sense of responsibility by introducing the concepts of tax deductions, allowances, and budgeting. This early exposure to the intricacies of taxation helps build a solid financial foundation and cultivates a proactive approach to managing one’s finances.

The Ever-Changing Tax Landscape: Staying Informed

Throughout our lives, the age at which we can stop filing taxes is subject to change due to evolving tax laws and regulations. Governments regularly review and adjust tax thresholds, deductions, and credits to accommodate economic fluctuations and social needs. It is crucial to stay informed and up-to-date with the latest tax regulations to ensure compliance and maximize potential benefits.

Subscribing to tax newsletters, following reputable financial publications, or consulting with tax professionals can help you stay abreast of any changes that may impact your tax obligations. By maintaining a proactive approach to understanding the ever-changing tax landscape, you can adapt your financial plans accordingly and make informed decisions regarding tax filings.

Conclusion:

The age at which one can stop filing taxes is a multifaceted question influenced by various factors, including income thresholds, filing status, and sources of revenue. From childhood to retirement, our tax obligations shift and evolve, necessitating a proactive and informed approach to ensure compliance with tax laws and regulations. By cultivating financial literacy, seeking professional guidance when needed, and staying informed about tax changes, individuals can navigate the intricate realm of taxation and strive for financial well-being at every stage of life.